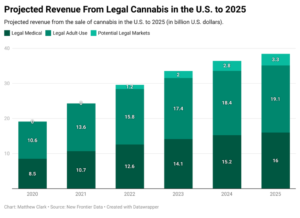

Much has been written about the size and growth of the Cannabis Industry. Mergers & acquisitions have —and will likely — continue to play a huge role in this large and growing industry. To put this in perspective, consider the industry growth of just the legal cannabis market in the U.S., depicted below as cited by New Frontier Data.

The New Frontier Data projects the U.S. legal cannabis market will reach a valuation of more than $35 billion by 2025. This means there is a lot of market share for bigger companies (which will look to small-scale cannabis businesses as an easy way to get footholds in new markets) to acquire.

California still has a large group of independent operators, which could be prime targets for larger cannabis companies to seek out mergers. This reality means a lot of M&A activity is likely in the California cannabis industry. Many have indicated that the hopes & dreams of most cannabis companies are to be acquired. Are you one of them? Are you ready or getting ready for this major goal?

As a partner in CFOs2GO, I have led 40 M&A transactions in several different industries, on both the buy & sell side. I want to help you make your dreams come true. The most important point is to be prepared. Get ready!

Here are some basics to address to be ready for an M&A transaction.

- Non-Disclosure Agreement (NDA) is generally a must to protect yourself.

- Due diligence is what the acquiring company will perform to confirm they want your company and help determine what they are willing to pay. I have prepared more than 40 due diligence packages to assure the acquiring party has a positive impression of your company. We can do this!

- Corporate records, contracts, Board minutes, etc. are important to be current and complete. Are your records current and complete?

- Online Data Room is an excellent tool to enhance preparedness. Do you have an online data room?

- Disclosure Schedule is an excellent tool to enhance preparedness. Do you have a complete disclosure schedule?

- Human Resources is your team, culture, experience and backgrounds. Yet, it is more…. Are you in compliance with the many employment laws and regulations? Are your employees paid appropriate amounts? Are your employee benefits competitive? Is all of this properly documented?

- Financial & Tax reporting is done monthly, accurately and in compliance with GAAP, 280e, Franchise tax board so there are no hidden problems with the SEC, IRS, Franchise Tax Board? If you don’t know the answer to these questions, you need to know!

- Debt & Equity financing is adequate for your company. Was your equity capital properly documented to avoid problems with the SEC or IRS? Do you regularly communicate with your investors and lenders?

- Projections are expected by all acquirers. Do you have 3-5-year projections? Are the projections supported by reasonable and defensible assumptions?

- Legal representation is important. Is your attorney well equipped to handle an M&A transaction? Is this a normal part of his/her business?

- Likely acquirers are known to you? Who are best strategic buyers? Why?

- Realistic terms of a successful transaction? Do you know the competitive valuation of your company?

- Negotiation of deal points is critically important. Are you the best one to negotiate on behalf of your company or should you get help from a professional?

- Letter of Intent (LOI) is also important. Are you aware of standard indemnification provisions? Are you aware of standard representations and warranties?

There is strong interest among pharma, agricultural and tobacco businesses, and others to enter the cannabis market. In the U.S., however, federal law is currently keeping most of these large businesses on the sidelines. Cannabis businesses in the U.S. have a unique opportunity to prepare for potential mergers and acquisitions that will certainly get underway as soon as federal regulations allow.

If you are contemplating opportunities for your business, we are happy to help!

Don Hawley brings more than 35 years of comprehensive global financial and operational management experience to our cannabis and agricultural-based clients. Don has many years of experience in early-stage strategic planning, leading to well-thought-out business plans and related goal setting and management systems to achieve focused goals. His accounting, finance, and operational experiences include strategy development and implementation, company transformations, acquisitions and divestitures, financial and operational systems implementations, profitability, and cash flow improvement programs.

Don Hawley brings more than 35 years of comprehensive global financial and operational management experience to our cannabis and agricultural-based clients. Don has many years of experience in early-stage strategic planning, leading to well-thought-out business plans and related goal setting and management systems to achieve focused goals. His accounting, finance, and operational experiences include strategy development and implementation, company transformations, acquisitions and divestitures, financial and operational systems implementations, profitability, and cash flow improvement programs.